Table of Content

Gesa makes banking as easy, convenient and secure as possible. Gesa credit union is committed to making a positive impact in the communities we serve. At MMFCU, we believe that true financial growth can only happen when we all grow together. We offer single close construction and remodeling loans. Kasasa Cash® checking makes it easy to get paid back. 2.00%APY on balances up to $10,000 if qualifications are met.

If any part of the agreement seems incomprehensible, do not hesitate to ask the lender about particulars. Become a certified home buyer and shop with more confidence, greater purchase power and close on your dream home faster.

Paying down or paying off your HELOC

You also have the option to set up automatic payments; you may do this through either your bank or your lender. From day one to close through each monthly statement, we go above and beyond to deliver a mortgage experience you’ll rave about. You'll receive a confirmation email and you can also print a copy of your payment details for your records. We require certified funds for a payoff of your mortgage loan. Home Equity loans let you borrow against the equity in your home.

Refinance today to a fixed or variable rate loan and receive $250. Please enter last four digits of your social security number. A loan with legitimate loan companies for bad credit is a simple but expensive form of borrowing to resolve financial hardship. The online lending business is high-risk for investors, and their capital is not protected from unfair borrowers. Lending organizations should clarify their fees before you sign a loan agreement.

What to focus on before applying for a loan with Union Home Mortgage

Our experienced mortgage loan officers will support you every step of the way. The lending company has a physical address and a secure website. Physical address should be an actual office address, and only a Post Office box is not enough. In addition, a company’s website must use a secure HTTPS connection to prevent a leak of borrowers’ personal information. You can recognize the secure website with a padlock icon near a domain name.

In contrast, even bad credit history debtors can borrow money from US lenders with personal or payday loans. We offer a variety of home loan options from refinancing to construction with competitive rates and features. With our new widget in online banking, it’s now easy to pay down your HELOC to a zero balance or pay it off entirely (after which we’ll close your HELOC account). By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies.

Curious about rates?

Applying for an online loan with a lending company doesn’t require paperwork or even visiting their office. Instead, a borrower can apply entirely online and receive money via direct deposit on the next business day. You need to have a good credit history to qualify for a credit card with a bank.

Your monthly mortgage payment will include more than just money for your house. If your mortgage is escrowed, you’ll be making payments toward several requirements each month. To clarify if there are any prepayment penalties on your loan, visit a branch, call your loan officer or send an email to Union Home Mortgage. Whether you’re a Patelco member or a Title Company, it’s easy to request the mortgage service you need with our online form—just have the loan number and property details ready. You are now leaving Mid Minnesota Federal Credit Union's website.

Reasons to Consider Refinancing

To get the information on the prepayment penalties, visit a branch, call your loan officer or send an email to Union Home Mortgage. Your escrow payments, which are collected to cover your homeowner's insurance and/or property taxes, are not guaranteed to remain the same during the life of your loan. Your homeowner's insurance and/or property taxes may change from year to year, so your total payment will adjust accordingly when we review your Escrow Account each year.

Access to your accounts is available through online banking, mobile app, or ATM anytime. We offer a convenient system that automatically debits your payment each month from your checking or savings account. To take advantage of this FREE service, log into our Servicing Website and enroll in our Automatic Payment program.

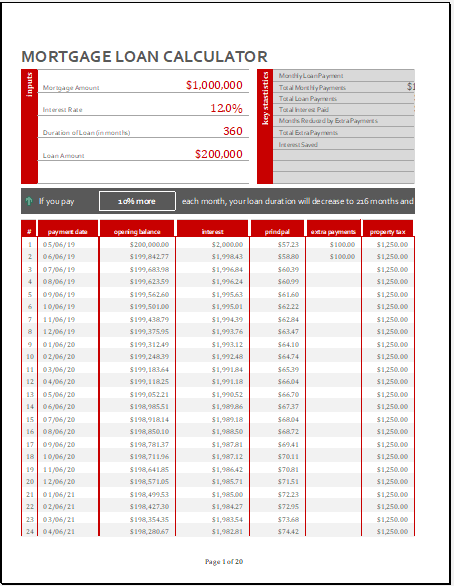

Chat with an MMFCU consultant, or see the options below, to find one suited for you. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Before you decide to purchase or refinance a home, make sure your new payment will fit in your budget. We’ve provided a wide range of calculators for you to use to determine what your payment could be. At Union Bank, we're committed to helping you make your home ownership dreams and refinancing needs a reality. Count on our skilled mortgage specialists for the personal, professional service you need every step of the way.

Enjoy competitive rates as well as closings with potentially no cost. For the latest information regarding COVID-19 and your mortgage payment options, click here. Wisconsin’s average property tax rate is around 2 percent of your property’s value. So, if you own a home in Madison assessed at $250,000, you can expect to pay around $5,000 per year in property taxes. Your principal and interest will be combined into one payment amount, but you can review your payment plan when you get your mortgage to see where your money is going.

If you provide the business with information, its use of that information will be subject to that business's privacy policy. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. Interest rates and annual percentage rate for a loan with an online lending company are significantly higher than with a credit card released by a bank. The money lending company is always interested in your credit history. The lender provides you its money, and you should beware of its proposal if a financial company doesn't seem to expect your repayments.

No comments:

Post a Comment